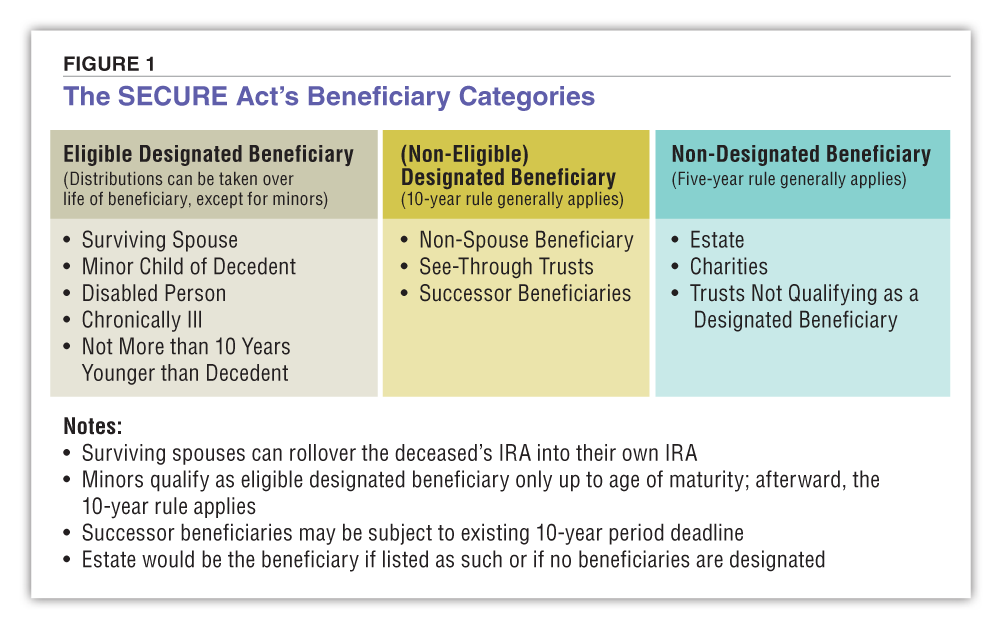

Inherited Ira Rmd Requirements 2024. Use oldest age of multiple beneficiaries. The class in which a beneficiary falls determines the rmd rules that apply to them.

With the 2023 tax year closed, the rmd requirement for inherited iras resumes in 2024. Alternatively, the beneficiary could take life expectancy payments starting the.

Alternatively, The Beneficiary Could Take Life Expectancy Payments Starting The.

The first date the original account owner was required to begin taking.

The Date Of Death Of The Original Ira Owner And The Type Of Beneficiary Will Determine What Distribution Method To Use.

Irs delays final ruling on changes to inherited ira required distributions until 2024, and extends the rmd penalty waiver to 2023 for certain beneficiaries.

The Setting Every Community Up For Retirement Enhancement Act Of 2019 (Secure) Act Made Major Changes To Ira Rmd Rules,.

Images References :

Source: rvpllc.com

Source: rvpllc.com

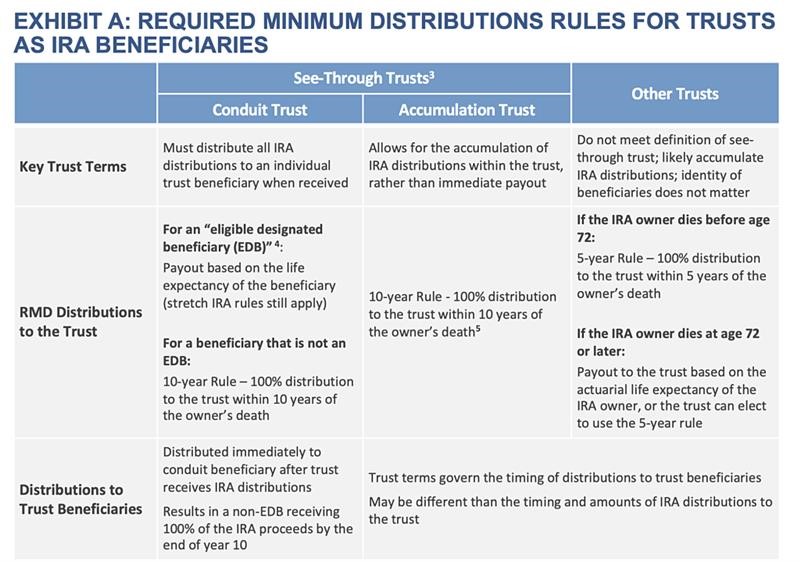

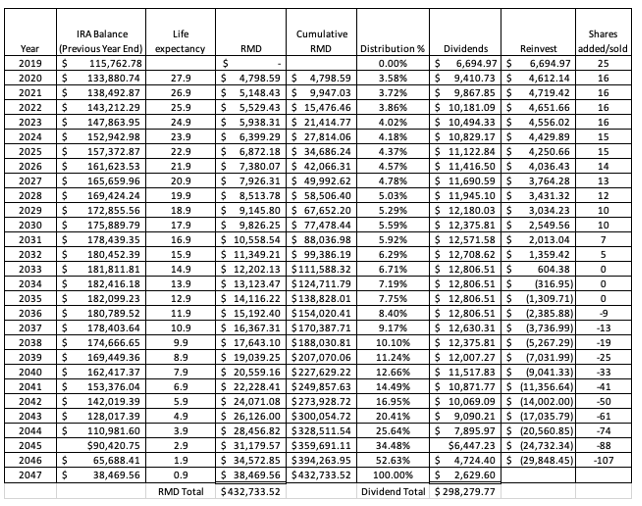

YearEnd Planning RMD & Inherited IRA Strategies Relative Value Partners, The irs announced a delay of final rules governing inherited ira rmds — to 2024. With the 2023 tax year closed, the rmd requirement for inherited iras resumes in 2024.

Source: www.jhwfs.com

Source: www.jhwfs.com

InheritedIRAFlowchart J. H. White Financial, The date of death of the original ira owner and the type of beneficiary will determine what distribution method to use. The irs announced a delay of final rules governing inherited ira rmds — to 2024.

Source: elchoroukhost.net

Source: elchoroukhost.net

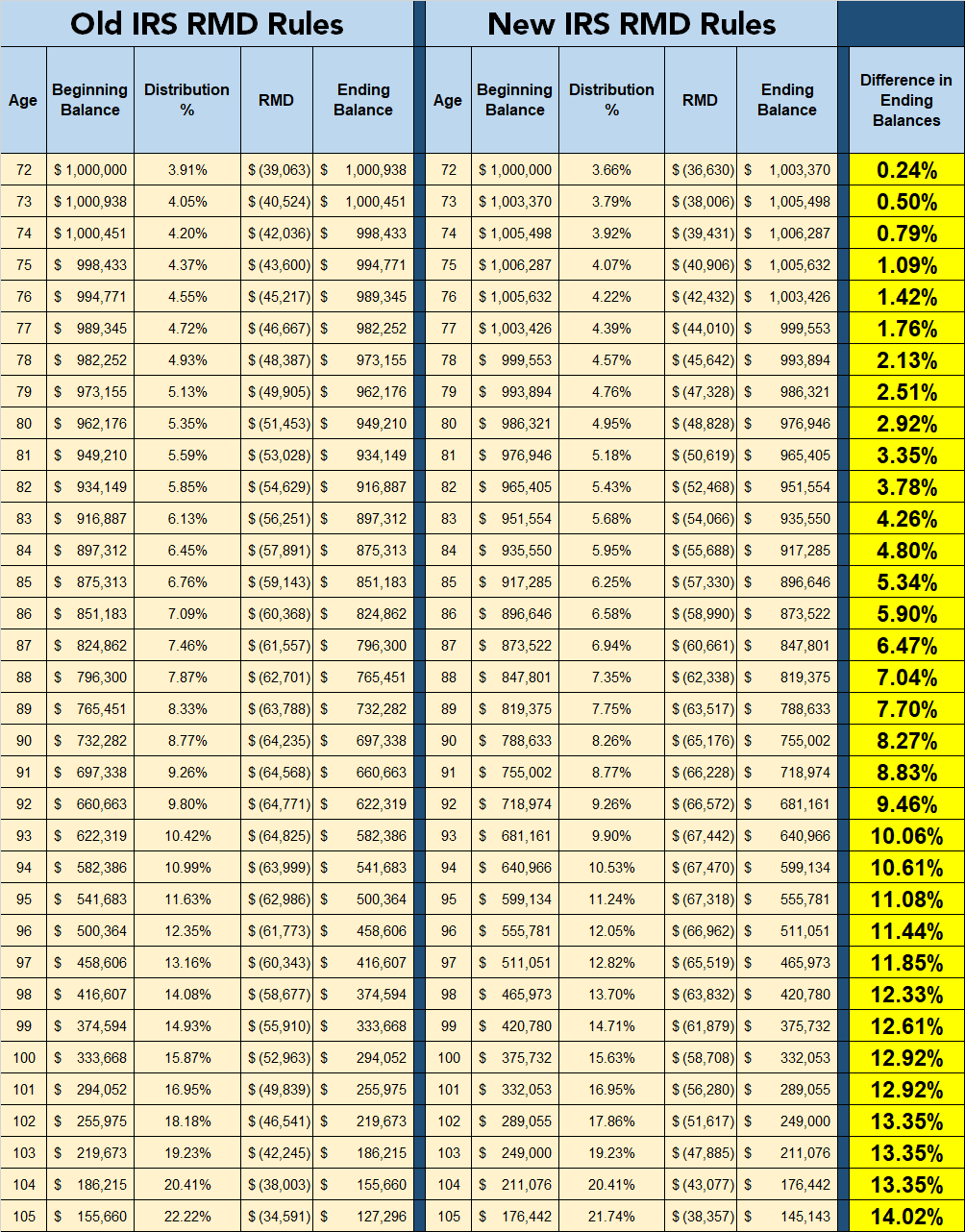

Rmd Tables For Inherited Ira Elcho Table, The class in which a beneficiary falls determines the rmd rules that apply to them. When you inherit an ira or roth ira, many of the irs rules for required minimum distributions (rmds) still apply.

Source: arleenqfarrand.pages.dev

Source: arleenqfarrand.pages.dev

Ira Rmd Tables 2024 Bel Melisandra, Use younger of 1) beneficiary’s age or 2) owner’s age at birthday in year of death. The secure act and inherited iras.

Source: elchoroukhost.net

Source: elchoroukhost.net

Required Minimum Distribution Table For Inherited Ira Elcho Table, Use younger of 1) beneficiary’s age or 2) owner’s age at birthday in year of death. If the original ira owner was required to take rmds at the time of their death, then rmd distributions are required based on the single life expectancy of the original ira owner.

Source: tutorsuhu.com

Source: tutorsuhu.com

What Are The New Ira Distribution Rules Tutorial Pics, When you inherit an ira or roth ira, many of the irs rules for required minimum distributions (rmds) still apply. The setting every community up for retirement enhancement act of 2019 (secure) act made major changes to ira rmd rules,.

Source: michaelryanmoney.com

Source: michaelryanmoney.com

New RMD Tables 2023 IRA Required Minimum Distribution That Retirees, And as a result of that notice, we. Because secure 1.0 creates a thicket of rules and classifications to wade through, the irs decided to waive missed rmd penalties for inherited iras from 2020 through 2024.

Source: www.cdwealth.com

Source: www.cdwealth.com

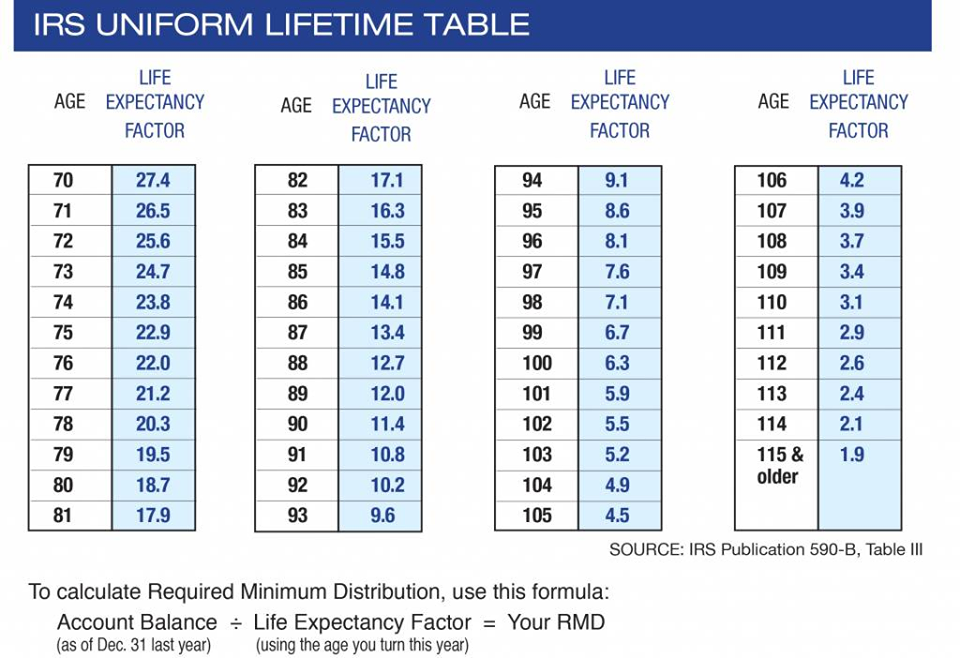

You’ve inherited an IRA. What happens next? CD Wealth Management, Reduce beginning life expectancy by 1 for each subsequent year. This calculator calculates the rmd depending on your age and account balance.

Source: brokeasshome.com

Source: brokeasshome.com

Inherited Ira Distribution Table, Other notable required minimum distribution (rmd) rules;. I am a spouse beneficiary of the original ira owner.

Source: cabinet.matttroy.net

Source: cabinet.matttroy.net

Rmd Tables For Inherited Ira Matttroy, The date of death of the original ira owner and the type of beneficiary will determine what distribution method to use. If you've inherited an ira, depending on your beneficiary classification, you may be required to take annual withdrawals—also known as required minimum distributions (rmds).

Any Individual Designated As The Beneficiary Of An Ira Or Retirement Plan;

Because secure 1.0 creates a thicket of rules and classifications to wade through, the irs decided to waive missed rmd penalties for inherited iras from 2020 through 2024.

An Inherited Ira Is An Individual Retirement Account That You Are Willed Upon The Previous Owner’s Passing.

This calculator calculates the rmd depending on your age and account balance.