Relief Bill 2024. The senate approved a $1.2 trillion spending bill in the wee hours of saturday morning to prevent a brief partial government shutdown, sending the bill to president. — more help and less itemizing could be coming for survivors of recent hurricane that hit southwest florida.

The second reading of the bill in parliament has been. Congress agreed on the $900 billion.

On Wednesday Night, The U.s.

The tax relief for american families and workers act of 2024 aims to take effect immediately upon passing, with certain provisions applied retroactively.

7024, The Tax Relief For American Families And Workers Act Of 2024, As Approved By The.

The bill provides for increases in the child tax credit, delays the requirement to.

Well, At Least The House Is.

Images References :

Source: fairfaxgop.org

Source: fairfaxgop.org

House Passes Emergency Relief Bill Fairfax County Republican Committee, 7024, the “tax relief for american families and workers act of 2024,” bipartisan legislation that would. Prime minister narendra modi is scheduled to reply to motion of thanks to president’s address in rajya.

The CARES Act Relief Bill and How it Can Help You as a Homeowner.pdf, Passed house (01/31/2024) tax relief for american families and workers act of 2024. Your browser will redirect to requested content shortly.

Source: www.youtube.com

Source: www.youtube.com

NEW STIMULUS RELIEF BILL Biden Passes Extra Relief Bill New, 7024, the tax relief for american families and workers act of 2024, as approved by the. This title modifies the calculation of the refundable portion of the child tax credit to require the multiplication of the credit amount.

Source: blog.stridehealth.com

Source: blog.stridehealth.com

What Does the 2 Trillion Relief Bill Mean for 1099 Workers? — Stride Blog, Under the proposed bill, the maximum refundable amount per child would rise to $1,800 in 2023, $1,900 in 2024 and $2,000 in 2025. 31 passed its version of the tax relief for american families and workers act of 2024, a milestone that brings the measure closer to.

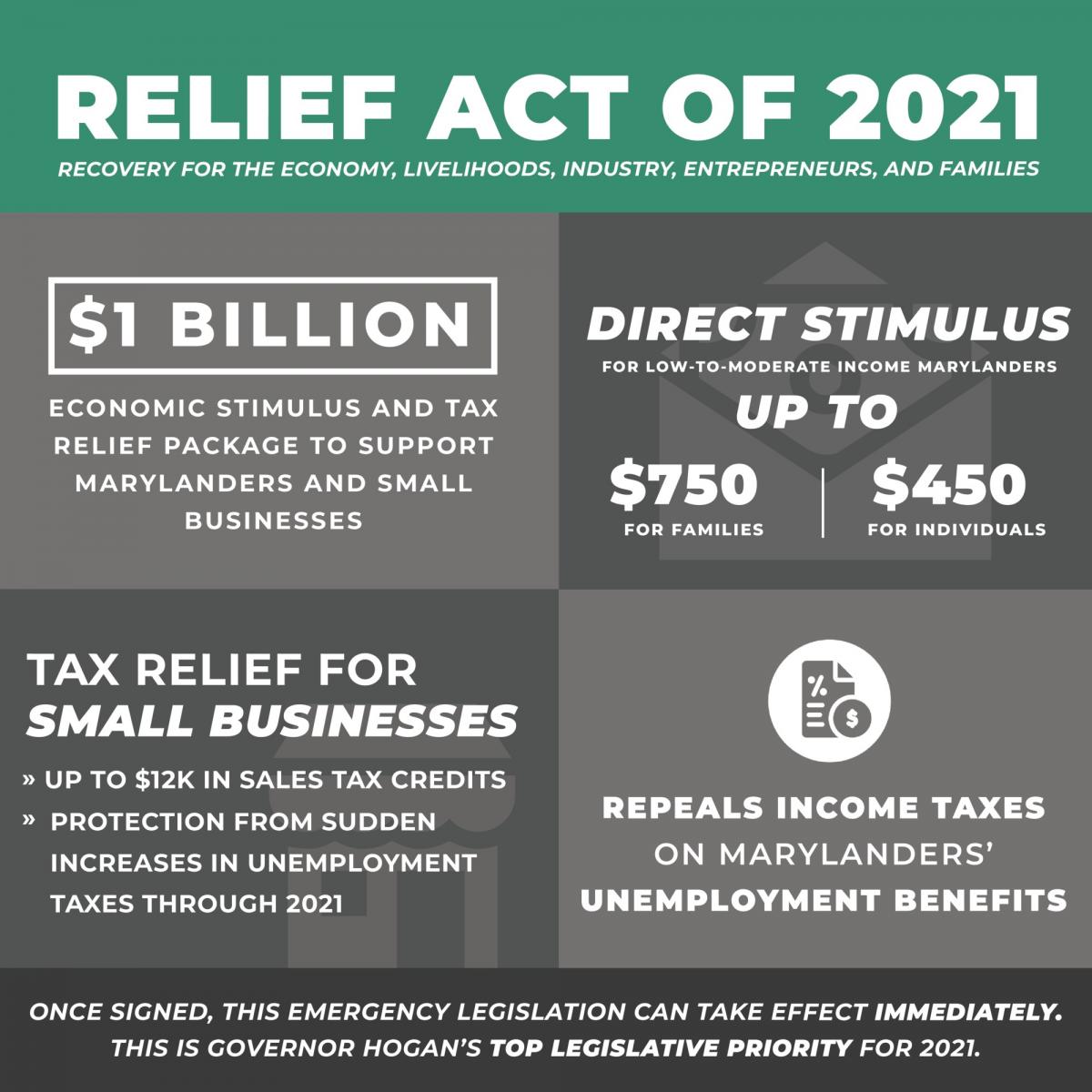

Source: www.northbeachmd.org

Source: www.northbeachmd.org

Governor Hogan Announces 1 Billion Emergency Stimulus and Tax Relief, This title modifies the calculation of the refundable portion of the child tax credit to require the multiplication of the credit amount. The tax relief for american families and workers act of 2024, passed by the house of representatives on january 31st, 2024, aims to provide tax relief and.

Source: www.oberlanderandco.com

Source: www.oberlanderandco.com

Watch Understand the new COVID Relief Bill in 18 minutes, The bill also modifies the child tax credit to be assessed on the number of qualifying children (as. 2) bill 2024 (widely referred to as the spring finance bill) was published on 14 march 2024.

Source: www.mystateline.com

Source: www.mystateline.com

U.S. House passes 3 trillion coronavirus relief bill, The second reading of the bill in parliament has been. The tax relief for american families and workers act of 2024 aims to take effect immediately upon passing, with certain provisions applied retroactively.

Source: www.virtuslaw.com

Source: www.virtuslaw.com

President Biden Signs New COVID Relief Bill Virtus Law, Prime minister narendra modi is scheduled to reply to motion of thanks to president’s address in rajya. What else would change with.

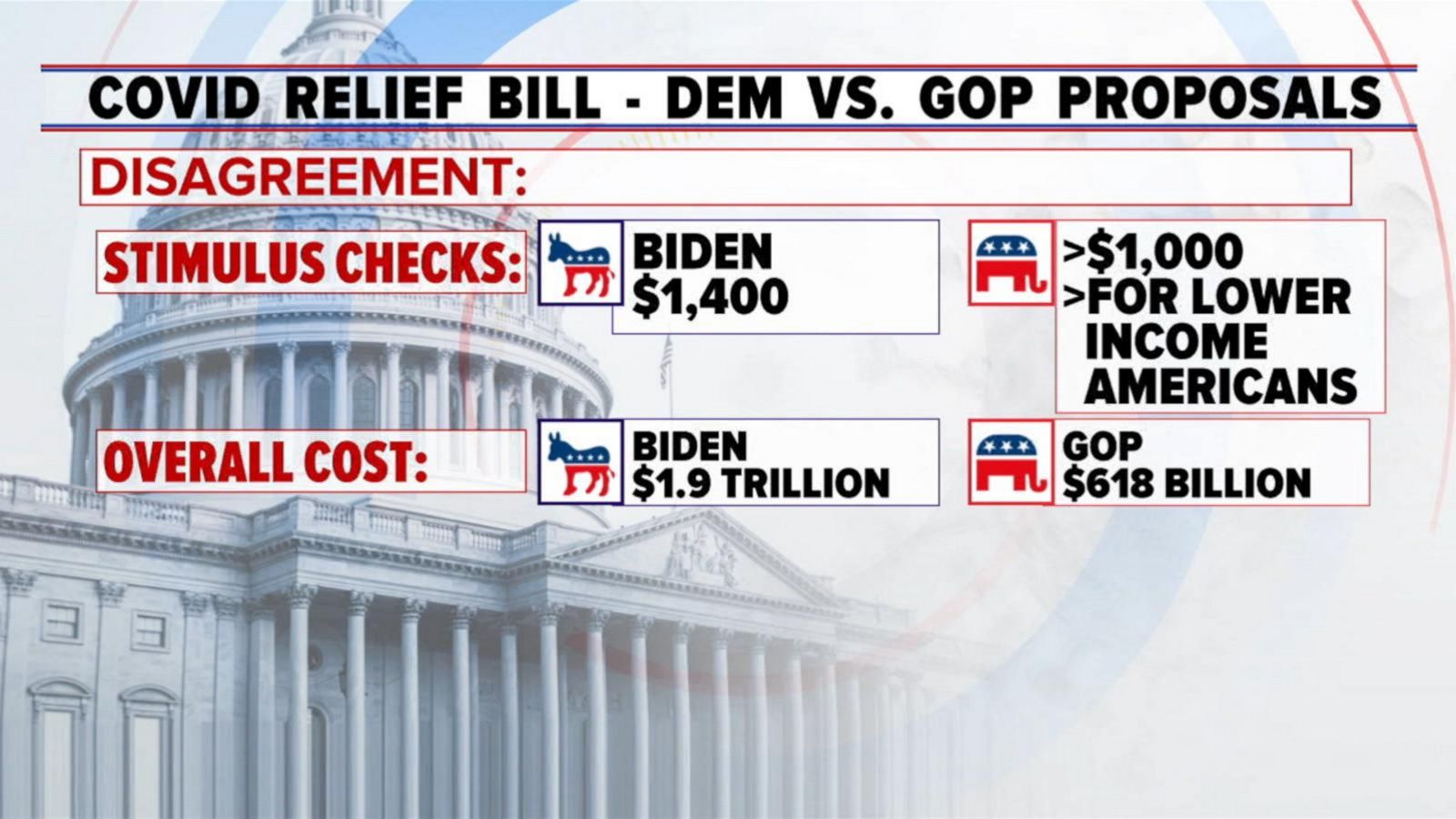

Source: www.goodmorningamerica.com

Source: www.goodmorningamerica.com

COVID19 relief bill battle Good Morning America, Well, at least the house is. Parliament budget session february 6 updates.

Source: fism.tv

Source: fism.tv

New Relief Bill Proposed By Bipartisan Lawmakers FISM TV, Parliament budget session february 6 updates. Under the proposed bill, the maximum refundable amount per child would rise to $1,800 in 2023, $1,900 in 2024 and $2,000 in 2025.

What Else Would Change With.

Your browser will redirect to requested content shortly.

—Under Current Law, The Maximum Refundable Child Tax Credit For A Taxpayer Is.

The law expanded the property.